Last year was particularly very trying and challenging for everyone. With the unprecedented COVID crisis came some levels of restrictions and limitations. This ranged from varying degrees of lockdown travel restrictions to other health risks and challenges.

The adverse effect of the lockdown and various restrictions was that our finances were brutally affected. Most families and companies sunk into financial crises. Data reveals that financial stress in America is at an all-time high. This is mainly due to a large number of layoffs by staff and employers.

Rising from the ruins this year, it is now important, more than ever, that everyone should have solid financial plans that can cater to unforeseen future circumstances.

Experts at the American Hope Resources have suggested different approaches as to how to take control over your finances with a view to gaining absolute financial freedom.

Why do you need to take control of your finances this year?

If you handle your finances well, it can provide you with a sense of security, knowing fully well that you can easily tend to your needs whenever they arise. Conversely, you may always feel like your life is one step away from a financial disaster if you don’t get a good grasp on money management.

Proper finance management drives your desire to earn from multiple sources rather than waiting on only your paycheque.

Savings or investments: which do you think is a better financial strategy?

Both are good financial strategies. At American Hope Resources, we encourage our clients to do both. The level of risk taken is the most significant distinction between saving and investing.

You will normally receive a lower return by saving, but you will be virtually risk-free. On the other hand, investing allows you to put your money into work and earn a more significant return, but it also exposes you to the danger of losing money.

Aside from investing, our team at American Hope Resources also encourages you to be aware of certain tax credits and deductions.

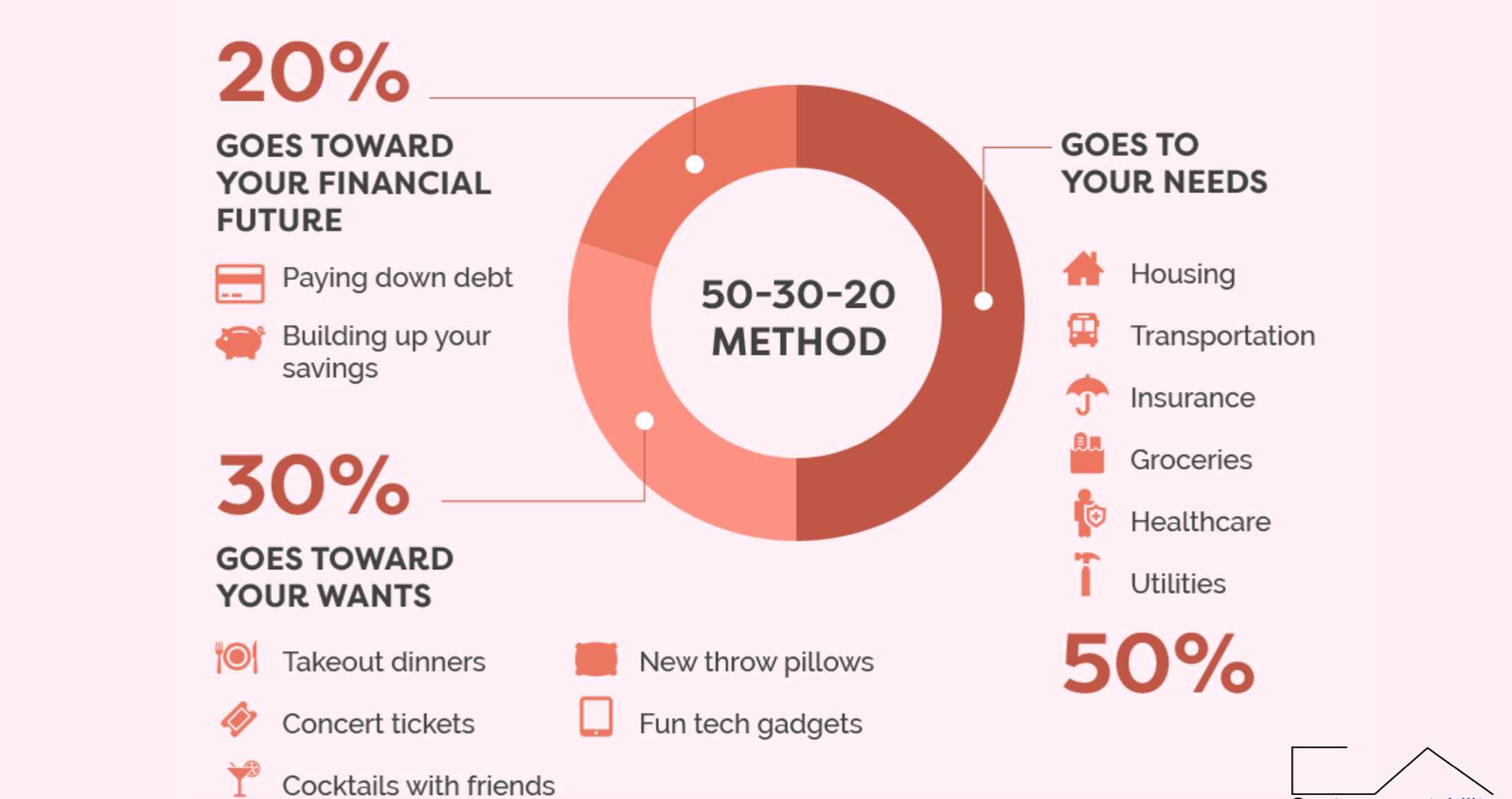

What is your take on the 50-30-20 budget rule about managing your personal finances?

The 50-30-20 budget rule is an interesting budgeting approach for individuals and households, and we recommend it at American Hope Resources. It was made famous by Senator Elizabeth Warren, a US law professor, in 2006.

She explained the concept of the rule as follows: that 50% of your total income be budgeted for needs, 30% for wants, and 20% for savings. However, American Hope Resources suggest that at least 5% of the savings be set aside for investment.

Will you recommend the use of digital tools to help in managing finances?

Yes. The world has gone digital, and many digital tools can be used to help you manage, monitor, and control your finances more effectively.

There are mobile applications that help you to track your spending. Also, spreadsheets can be utilized to help you with budgeting. You can also use a Digital Spend Management System to help you manage your spending.

What are some of the best strategies people can employ to take absolute control over their finances this year?

Taking control of your finances may appear to be a daunting process. But if you follow the following guidelines from our experts at American Hope Resources, you will be able to find a better approach.

- Read books on financial literacy and strategies.

- Set up a budgetary plan that suits your income and expenditures

- Get multiple streams of income

- Cultivate a good savings habit

- Always have a financial plan.